Rocket Homes search will be available in 10 additional states by the end of 2018, and will be rolled out nationwide by mid-2019.įor more than 10 years, In-House Realty’s core business has been matching home buyers and sellers with qualified, vetted real estate agents in all 50 states and 3,100 counties in America. The home search feature is currently available to consumers in the company’s home state of Michigan. Along with traditional data like the number of rooms, square footage, and price, Rocket Homes provides neighborhood information including market trends, housing supply, and the level of demand for housing in the specific areas consumers are looking to buy or sell in.

Let’s get into how the grant is calculated.As part of the rebranding, Rocket Homes unveiled a new website that features home search functionality. It’s to your advantage to use the grant of the team member with the highest tenure. If multiple members of your household are employed by an eligible Rocket Company, only one grant may be used. The only exceptions are if, within a year of receiving the grant, you’re terminated for certain reasons or you voluntarily leave the company. Because it’s a grant, you generally won’t be required to pay it back. This is available for all loan programs offered by Rocket Mortgage ® except FHA loans. Where available, real estate services should be provided by Rocket Homes SM. The home has to be a primary residence in the U.S. The grant is available for first-time home buyers with at least one year of full-time tenure as a direct hire in good standing at an eligible company at the time of closing. Although this is commonly referred to as down payment assistance, the funds can also be used to cover closing costs.

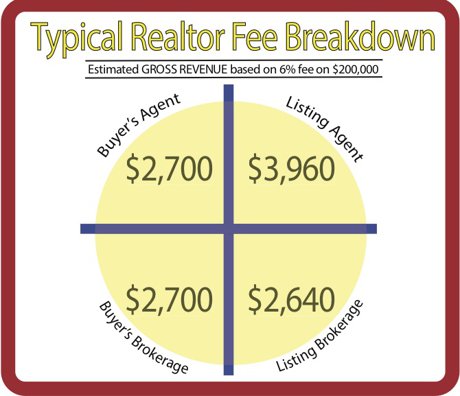

The Rocket Home Grant provides up to $10,000 to eligible team members working at one of our U.S.-based companies for down payment assistance. That’s where the Rocket Home Grant comes in. If you bring more to the table to begin with, there’s less risk for any lender because the loan isn’t as costly.įor both these reasons, having as much money for a down payment as you can get your hands on is very beneficial. Still, if you’re purchasing a $200,000 home, it’s not unreasonable to think you might spend $18,000 at closing by the time all the other costs are added in.Īnother factor to keep in mind is that the bigger your down payment, the lower your interest rate will be if everything else is held equal. If you qualify for a conventional loan as a first-time home buyer, you can get into a home with a down payment as low as 3%. There are ways to lower these costs – by taking lender credits or negotiating seller concessions – but we generally recommend home buyers plan for closing costs in the range of 3 – 6%. There are also closing costs associated with any mortgage. Although the prevailing wisdom of past generations that you need 20% down no longer applies, it’s still a significant upfront expense. The down payment is often the single biggest obstacle facing first-time home buyers when they buy a home of their own.

0 kommentar(er)

0 kommentar(er)